Software-Defined Satellites offer an attractive potential solution to address the rigidity constraint imposed on current Geostationary Earth Orbit satellites.

Brussels, Munich, Montreal, Paris, Sydney, Toulouse, Tokyo, Washington D.C., April 15, 2024 – The satellite communications market has seen significant changes across its value chain, bringing forth new technological innovations that include flexible satellites and more specifically, Software-Defined Satellites (SDS). Geostationary Earth Orbit (GEO) satellite operators have been compelled to respond to increased competition amidst these market shifts. One approach is to optimize the utilization of GEO satellites; however, the rigidity and fixed capacity of traditional GEO satellites is a notable constraint. Therefore, the advent of flexible satellites presents an attractive solution to a variety of problems.

Novaspace, a merger between Euroconsult and SpaceTec Partners, presents its latest report highlighting new opportunities by leveraging flexible satellites and software-defined satellites. Such satellites can be reconfigured while in orbit, enabling them to adapt to changing demands without necessitating costly replacements. Software-defined satellites represent a promising avenue for enhancing adaptability and addressing specific consumer needs; however, the extent of their implementation will vary depending on the unique requirements of different consumers. Satellite operators will need to focus on the specific capabilities of the consumer to determine if SDS presents a viable and sustainable solution. Software-defined satellites offer in-orbit reconfiguration of various parameters including beams, coverage areas, bandwidth, power levels, and frequencies. The adaptability stems from the reconfigurability of payload parameters enabled by software-defined satellites. The standardized and modular platforms of these satellites yield efficiencies for both manufacturers and operators, resulting in cost savings and expedited time-to-market. Moreover, military users benefit from enhanced resilience and security offered by this type of satellite.

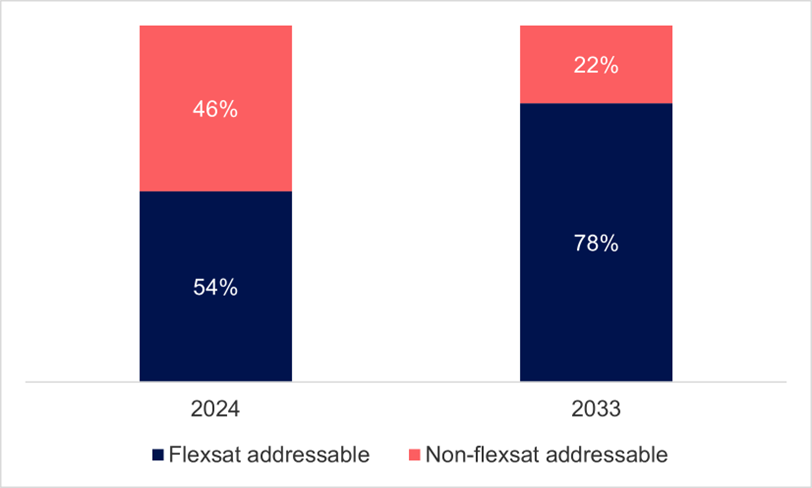

Novaspace’s Software-Defined Satellites report estimates the adoption of flexsats will grow steadily over the next decade. Currently, 54% of satellites are deemed to be addressable by flexible payloads and platforms. By 2033, this figure is projected to increase to nearly 80% with High Throughput Satellite (HTS) and Very High Throughput Satellites (VHTS) anticipated to be the main drivers in the adoption of flexsats.

“While flexsats offer advantages in terms of adaptability and cost efficiency, it is important to note that they are just one solution among many,” says editor and Novaspace’s managing consultant, Xavier Lansel. “They should not be considered the sole answer to all challenges faced by satellite operators. Other technologies and approaches may provide more diverse and practical approaches.”

GEO COMMUNICATIONS SATELLITES FORECAST

The increased complexity of software-defined satellites brings with it inherent challenges, issues and an increased risk of failure. Despite promises of shorter time-to-market, leading satellite manufacturers such as Airbus and Thales have faced production delays of up to 2-3 years resulting in increased costs to compensate for the issues. Capacity limitations also pose a challenge as current variants of fully software-defined satellites currently are limited to 150 Gbps of capacity compared to partially flexible VHTS models supporting more than 500 Gbps. This means, when missions require a high-level of overall capacity, partially flexible payloads will be more adept at sufficiently meeting customer needs. Nevertheless, the combination of flexibility, capacity and cost makes software-defined satellites attractive to broadband mobility markets and opens new opportunities for national/regional operators, albeit riskier opportunities, amidst high costs to dedicated HTS or VHTS systems.

The future of the satellite communications market is forecast to be highly specific to customer needs, therefore, satellite operators will need to focus on customizing their satellites as much as possible. Software-defined satellites are expected to contribute to the expansion of the satellite communications market; however, software-defined satellites may not offer a universal solution for all consumers as they may not be equipped to fulfill all market requirements. Satellite manufacturers will need to address various challenges to ensure widespread adoption of software satellites. Whether overcoming these limitations will prove advantageous in the long term will depend on customer needs.