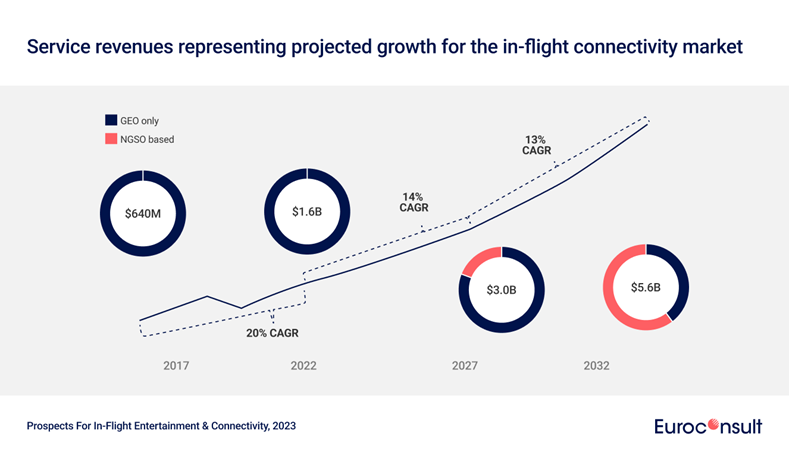

Airline In-Flight Entertainment and Connectivity services are expected to become more widely accessible over the next decade due to increasing demand and the emergence of new delivery services from the likes of Starlink and OneWeb, delivering additional capacity. Euroconsult predict the number of connected aircraft to reach 60,000 within less than a decade, with related service revenues expected to grow from $1.5bn to $3.4bn by 2032.

Paris, Washington D.C., Montreal, Yokohama, Sydney, October 03, 2023. A report published by leading space consulting and market intelligence firm, Euroconsult, focusing on In-Flight Connectivity (IFC) for air travel has highlighted a second consecutive year of strong growth, with over 36,000 commercial and business aviation aircraft now equipped with onboard internet access. The new study marks the 11th edition of an annual report entitled ‘Prospects for In-Flight Entertainment & Connectivity’ and predicts this number to grow steadily over the coming years, to almost double by 2032, as part of an overall market that could see service revenues reach as high as $3.4bn.

The report is compiled from a decade of forecasting data and five years of historical results, producing extensive databases with hundreds of data points, covering the number of connected aircraft per segment and per technology as well as service providers’ and satellite operators’ revenues linked to satellite capacity allocated to In-Flight Connectivity. It contains details on global trends and forecasts across both geographical regions and technologies, featuring key metrics of IFC systems and service provision with a focus on areas such as passenger options, Smart Plane concepts, the value-chain of the IFC ecosystem (including company profiles of network operators, service providers and equipment manufacturers) and detailed analysis of the commercial and business aviation markets.

Overall, the report anticipates a positive trend up to 2032, due to rising demand from passengers and an increased abundance in bandwidth availability. Although emerging non-governmental service organizations will reduce costs, the increased demand facilitated by the increased supply is likely to offset the decreasing capacity prices. All of which has led the expert consulting firm to predict satellite operator revenues to grow from $350m last year, to $1.6bn by 2032.

In 2022, Starlink launched its suite of aviation services with companies such as AirBaltic, JSX and Hawaiian being first adopters while others waited for initial results and this development, when combined with the anticipated arrival of OneWeb to the market next year, has led Euroconsult analysts to predict that non-governmental service operators will play an increasingly prominent role in the growth of the in-flight connectivity market in the months and years ahead. Starlink’s fast-growing satellite constellation was recently found to have heavily impacted the maritime market as services were rolled out, catalyzing a flurry of new contracts and opportunities as highlighted within Euroconsult’s recent Prospects for Maritime Satellite Communications report. Although not delivering the same immediate impact for the aviation market due to the operational and financial roll-out challenges that come with a more complex regulatory environment, Starlink and OneWeb’s services are expected to have a heavy influence on the availability of In-Flight Connectivity and Entertainment supply going forward.

A particularly interesting question that often arises in relation to the provision of onboard broadband access is around cost or, more specifically, the potential for airlines to move towards offering the service as a free of charge benefit for all passengers. Although there is a general belief from the industry that the market will develop in such a way in time, it is not certain when the free provision of this service will occur as standard across the majority of airlines. In the meantime, airlines are finding inventive ways to offer complementary services wherever they can, with an increasing number enabling some degree of free access, for example through messaging services or no-cost upgrades for members of loyalty programs An important point in relation to this question is of course the knock on effect that any full shift towards the free supply of internet connectivity would have on the demand for capacity, and what changes would be required in order to serve that broader and continuous demand, that would allow all passengers to access a range of information during their flight, from receiving and sending emails to streaming video and participating in conference calls.