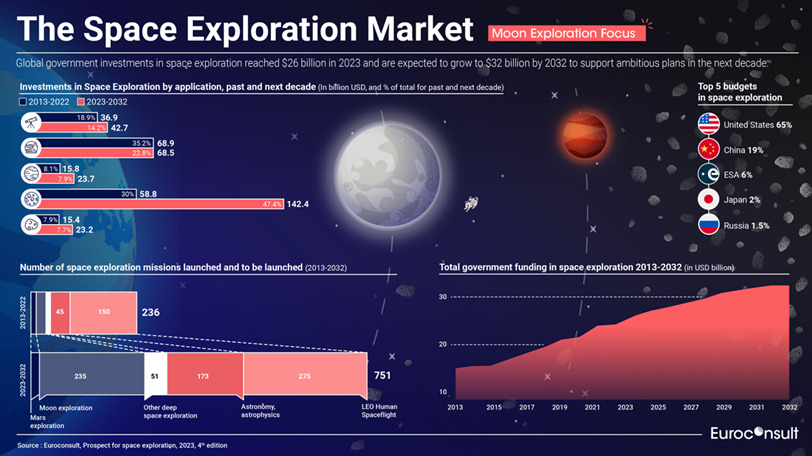

Global government space exploration funding hit $26 billion in 2023 and is projected to surge to nearly $33 billion by 2032. Key areas of growth, revealed in Euroconsult’s latest ‘Prospects for Space Exploration’ report, include lunar exploration, LEO human spaceflight and Mars exploration. The emerging lunar exploration duopoly between the U.S.-led Artemis program and China’s International Lunar Research Station (ILRS) is highlighted along with increasing private sector involvement.

Paris, Washington D.C., Montreal, Yokohama, Sydney, October 02, 2023. Lunar exploration is the catalyst behind an unprecedented surge in the space exploration sector which saw global government investment rise to an impressive $26 billion during 2023. Ambitious lunar missions are projected to boost investment to nearly $33 billion by 2032, a growth trajectory which underscores lunar exploration’s pivotal role in shaping the future of space exploration. The figures are revealed in the just published fourth edition of Euroconsult’s ‘Prospects for Space Exploration’ report.

Market expansion is anticipated to continue fueling global investment and, over the next decade, Moon exploration is expected to achieve a remarkable 5% 10-year compound annual growth rate (CAGR), ultimately reaching nearly $17 billion by 2032. The surge in funding will primarily support upcoming human spaceflight missions, necessitating substantial investments in transportation and orbital infrastructure. Additionally, increased investments in robotic lunar missions will help pave the way for a sustained human presence on the Moon.

The second-largest space exploration investment stream is human spaceflight in low Earth orbit (LEO), an area that experienced a dip in recent years following the completion of major government and public-private programs. A new investment cycle is on the horizon, peaking at $7 billion by 2030, and this will support the final years of operation and decommissioning of the International Space Station (ISS) as well as increased investments to ensure a smooth transition of post-ISS LEO operations into the private sector.

Mars exploration investments are also expected to grow steadily, with a 2% 10-year CAGR, to surpass $2.5 billion by 2032. These investments will be primarily directed towards already planned missions, notably sample-return missions, which will contribute to growth in this sector.

Other Deep Space exploration funding is predicted to continue on an upward trajectory, averaging around $2 billion by 2025 and demonstrating an on-going global commitment to exploring the far reaches of our solar system. Astronomy, Astrophysics & Heliophysics, with a current annual spend level of $4 billion, is expected to persist throughout the decade and remain significant fields of interest for space agencies worldwide.

Overall, the coming decade is poised to witness a surge in space exploration missions to a total of over 750, which represents a substantial increase from the 236 missions conducted in the previous 10 years. Human spaceflight in LEO will dominate, accounting for 36% of the total, closely followed by lunar exploration at 31%. The commercial space exploration sector is rising too and will comprise 31% of the total missions, an increase driven by both LEO, including crew and cargo transportation missions, and lunar exploration endeavors.

The focus on lunar exploration is driven by a blend of strategic and geopolitical motivations and establishing a sustainable presence on the Moon is considered a pivotal step toward enabling future human missions to Mars. This has resulted in the emergence of a duopolistic context in lunar exploration, with the U.S.-led Artemis program and China-led International Lunar Research Station (ILRS) program taking center stage.

Natalia Larrea, Director of Euroconsult USA, stated: “We are on the verge of a new era in space exploration marked by a paradigm of collaboration and competition. Establishing a sustainable lunar presence is the main global focus, while also maintaining a sustained LEO human presence.”

“This transformative era in space exploration is not limited to governments alone; the private sector is playing an increasingly significant role. Fueled by renewed interest in space exploration from governments worldwide, numerous companies are seeking to provide commercial services in space exploration,” she added.

Euroconsult’s ‘Prospects for Space Exploration’ report also highlights the existence of numerous challenges and risks. Business cases in this sector still heavily rely on government contracts in the near- and medium-term, emphasizing the need for sustainable economic models as the lunar and LEO economies continue to develop.