Connectivity for all is becoming an increasing priority for governments across the world, especially in developing and remote regions where broadband services are being enabled by the lowering costs of emerging satellite constellations. Euroconsult estimates that service revenues within the universal satellite broadband access market will reach $18 billion by 2031 at a CAGR of 15%.

Paris, Washington D.C., Montreal, Yokohama, Sydney, April 12, 2023. Internet usage has doubled in the past eight years, with an estimated 67% of the world population using broadband services in 2022, according to the world’s leading authority on space and satellite-based applications markets, Euroconsult. From access to public services such as remote health advice to remote working and learning and the ability to communicate opinions and share information, universal connectivity has become an increasing priority for governments across the globe.

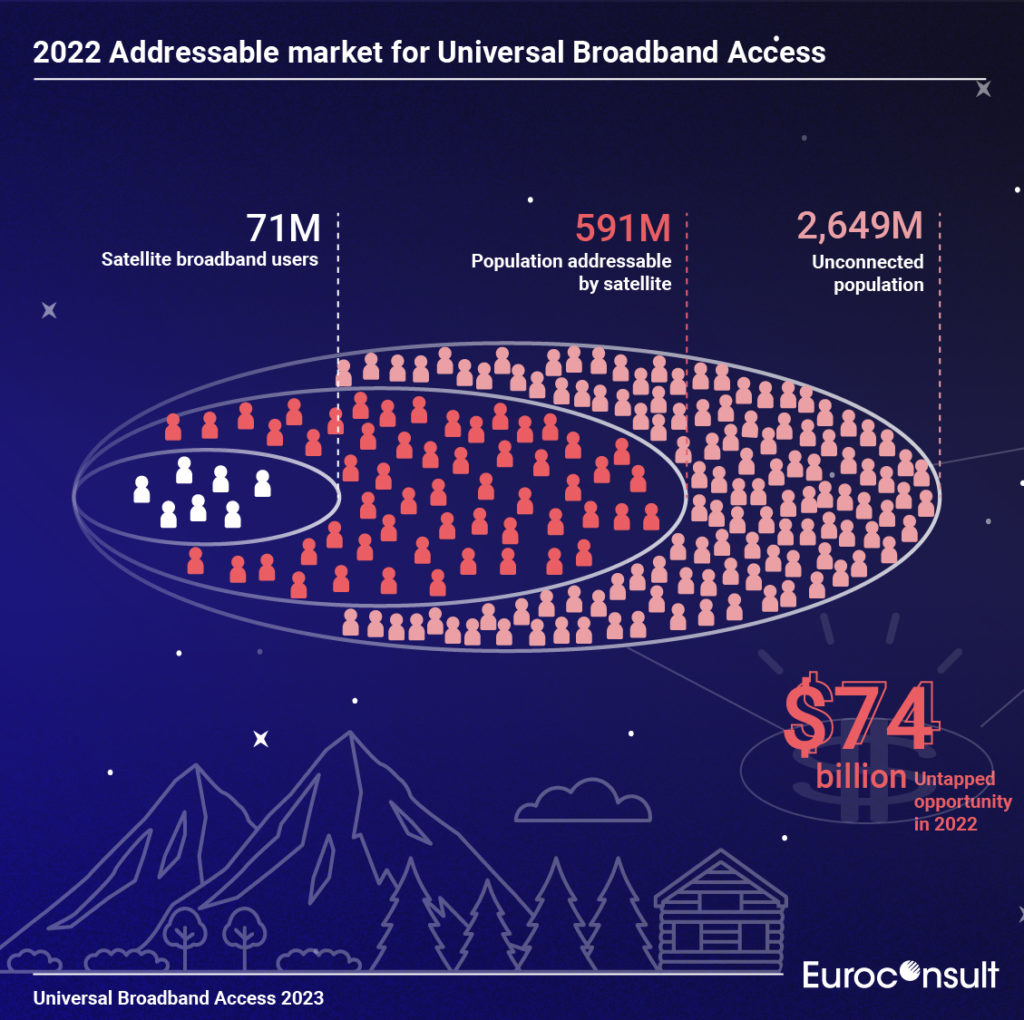

While international organizations are encouraging infrastructure development plans for broadband use and accessibility in unserved areas, some 2.6 billion people remain unconnected. In its latest report on Universal Broadband Access (UBA), Euroconsult mentions that the least-developed and landlocked developing countries are particularly lagging, with just over one-third of their populations connected to the internet. Asia Pacific and Sub-Saharan Africa alone hold 85% of the world’s unconnected people, with a quarter located in India.

“With access to broadband services increasingly recognized by governments as a driver of economic growth, this represents a significant untapped opportunity for service providers, estimated at $74 billion in 2022,’’ said Dimitri Buchs, Managing Consultant at Euroconsult and the Editor in Chief of their UBA report.

Mobile Internet has been the primary growth driver for network expansion and Internet subscriptions in recent years. However, despite mobile network availability to over 95% of the world’s population, at least in the form of 3G, service affordability and lack of digital skills are yet to be fully addressed. This has created an “adoption gap” – people do not use Internet services even when coverage exists where they reside. In 2022 only 100+ countries met international broadband affordability targets.

“This highlights the need for government and commercial initiatives to refocus efforts to close the digital divide beyond the expansion of coverage. We anticipate that at least one billion people, mainly those living in extreme poverty and uninterested in accessing internet services, will remain off the grid by the early 2030s,” said Buchs.

More notably, however, governments and international organizations are shifting their focus towards ‘meaningful connectivity’ – a combination of sufficient download speeds and data allowances with an adequate device and frequent access to the Internet.

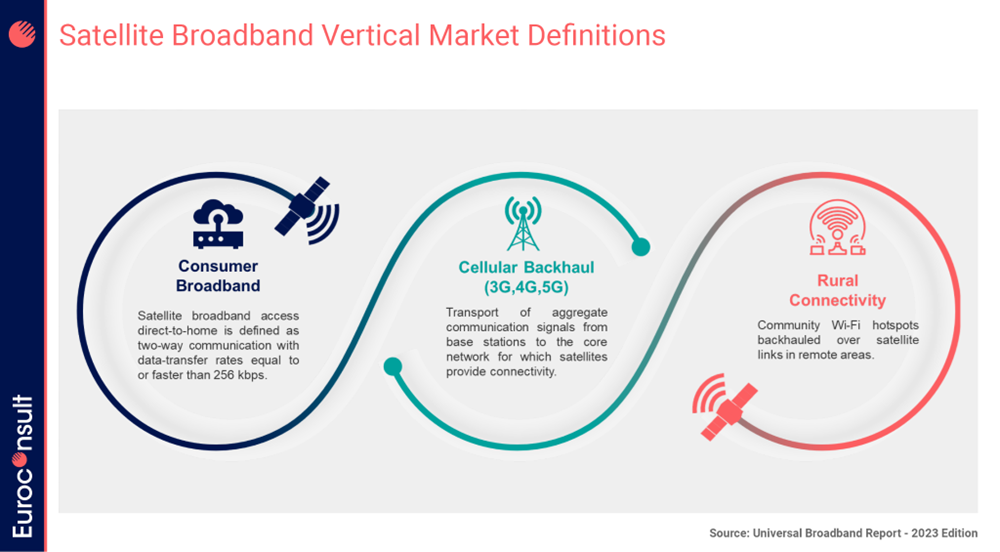

Governments are adopting multiple strategies to expand and secure meaningful connectivity for all, turning to satellite as the more cost-effective option for low-density areas where terrestrial network deployments are not economically feasible. Today, three main satellite solutions are used to address the universal access broadband market: consumer-grade broadband, cellular backhaul, and rural connectivity.

According to Euroconsult’s report, the addressable market for satellite solutions reached 591 million people in 2022, with 71 million people connected to satellite broadband services at the end of the year, a number expected to more than double in 2031 to reach over 150 million users. Consumer broadband is currently the dominant satellite option in advanced economies, while cellular backhaul is the most frequently used option in emerging markets, mainly due to the lower cost of services for end-users.

The rollout of satellite constellations and next-generation high-throughput satellites (HTS) planned in the coming years will be crucial in helping reduce the digital divide, enabling satellite services to offer increasingly affordable entry-level satellite services. Upcoming HTS services will also provide ‘better quality’ packages to users through unlimited plans and higher data rates.

Other opportunities exist for satellite services to expand their addressable market in the coming years. These include vehicles in motion like RVs, such as Starlink Roam service, and the direct-to-device (D2D) market. The D2D satellite service landscape is particularly gaining momentum, supported by new regulations – like the FCC rule-making – and new 5G standards (through 3GPP) to integrate satellites into terrestrial networks more seamlessly.

Euroconsult’s latest ‘Universal Broadband Access’ report is out now, providing detailed insights into the three satellite connectivity segments and the effects of satellite constellation services on the UBA market.

About the Report

Universal Broadband Access – A Complete Analysis & Forecast of the Satellite Universal Broadband Access Market (April 2023) is the second UBA report from Euroconsult offering a complete analysis and forecast of the satellite broadband market. It includes a detailed discussion of the addressable markets, a strategic analysis of the economics and opportunities, a comprehensive market assessment, and a market forecast through 2031 with trends and forecasts broken down by region and vertical market. Premium content is also available with detail on key macroeconomic indicators by country, detail on the number of satellite terminals installed by country, including consumer broadband subscribers, number of Wi-Fi hotspots, and number of cellular backhaul sites, addressable market for satellite forecasts by region, and a satellite universal broadband projects database.