The combined market for Earth observation commercial data and services to support agriculture reached $480 million in 2019. With an expected two-fold increase in market value by 2029, several new satellite constellations set agriculture at the forefront of their business plans to address this untapped potential.

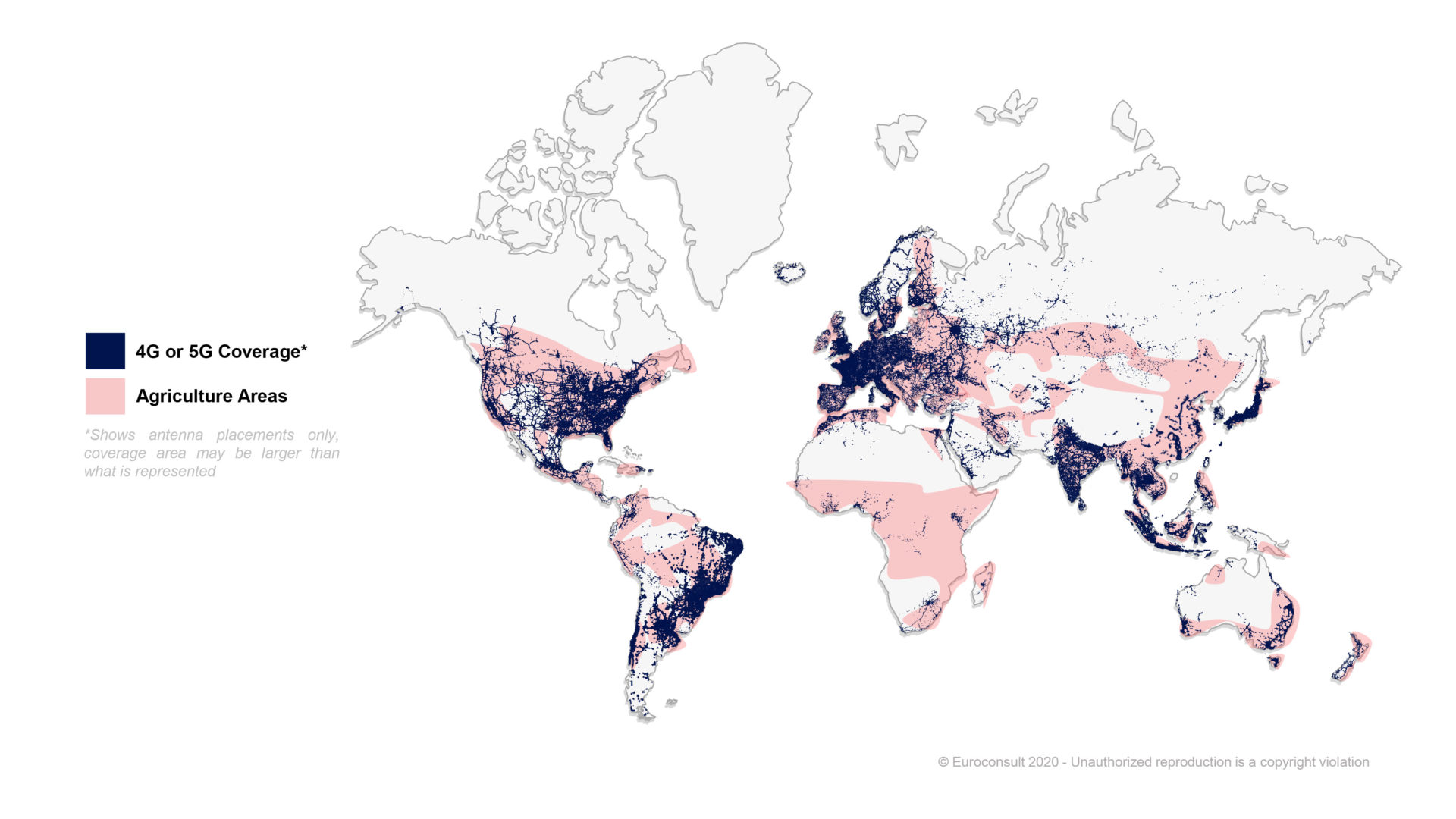

Paris, Washington D.C., Montreal, Yokohama, 20 October 2020 – For its latest research titled, EO4AG – Earth Observation for Agriculture, Euroconsult has teamed up with TerraMetric, a US-based, global business development firm focused on geospatial and new space markets, to provide an in-depth analysis on the global trends, vertical integration opportunities and regional demand forecasted for Earth observation-based services and products addressing the agriculture sector. The two companies forecast that by 2029, the total agricultural market is expected to double in value to reach over $815 million. While government-driven sales are foreseen to remain significant, the uptake of precision agriculture solutions within the private sector due to expected near-global broadband coverage is expected to be the main catalyst behind this anticipated market growth.

Precision agriculture incorporates a broad range of technology areas. In this context, it refers to supporting commercial agricultural supply chains by providing Earth observation-based solutions and tools to back farming optimization processes, as well as research and development initiatives. For precision agriculture to evolve, connectivity will be key. Several outside factors such as, the expansion of automated analytics and the emergence of Low Earth Orbit (LEO) broadband constellations, are expected to catalyse a momentous growth in the reach and efficiency of existing precision agriculture capabilities, thanks to better connectivity. Drawing on these trends and technology developments, the total addressable market for precision agriculture is thus expected to equate to a little over $4 billion by 2029, according to the research’s forecasts.“At a time when the advancements in connectivity brought by new Low Earth Orbit (LEO) constellations are poised to transform the precision agriculture market, partnering with TerraMetric, has been invaluable for us to be able to provide our clients with a two-folded approach by which we sought to bridge the knowledge gap between the Earth observation community and the AgTech market”argued Pacôme Révillon, CEO of Euroconsult.

“As a company that specializes in bringing new space tech and geospatial data to market in order to support a wide-range of businesses, we could clearly see, in our analysis, the largely untapped potential for Earth Observation data to support commercial agricultural supply chains”, explained TerraMetric CEO, Clint Graumann.“While the precision agriculture market has made great strides, it has significantly more potential if the right service models and solutions can be found. With this research we aimed at providing Earth observation companies with more clarity as to how the agriculture sector does business, while presenting AgTech stakeholders with a holistic assessment of the solutions coming to market in the next 10 years.”

The research addresses and provides an analysis of several technology and market drivers, including:

- •Earth observation satellites and services providers: applications and missions

- •The agricultural supply chains – Earth observation data users and their needs

- •The impact of global connectivity on addressable markets

- •Benchmarking Earth observation – what can it bring to agriculture

- •Regional market variations in requirements and data needs

- •Upcoming Earth observation-based solutions and agriculture market take-up potential

- •Beyond Earth observation: further technology advances and trends impacting the sector

About the research

Along with a comprehensive analysis of agriculture supply chains, its competitive landscape, and agriculture stakeholder’s information needs and challenges, the research also zooms-in on the key technologies, connectivity trends and shifting business models expected to fuel the market for Earth observation in agriculture in the next decade. In addition to detailed agriculture stakeholders benchmarking, included also in this research, are ten-year market forecasts related to the market uptake potential of Earth observation-based solutions in agriculture across seven regions worldwide.

It is available now and can be ordered from the Euroconsult shop and the TerraMetric website.