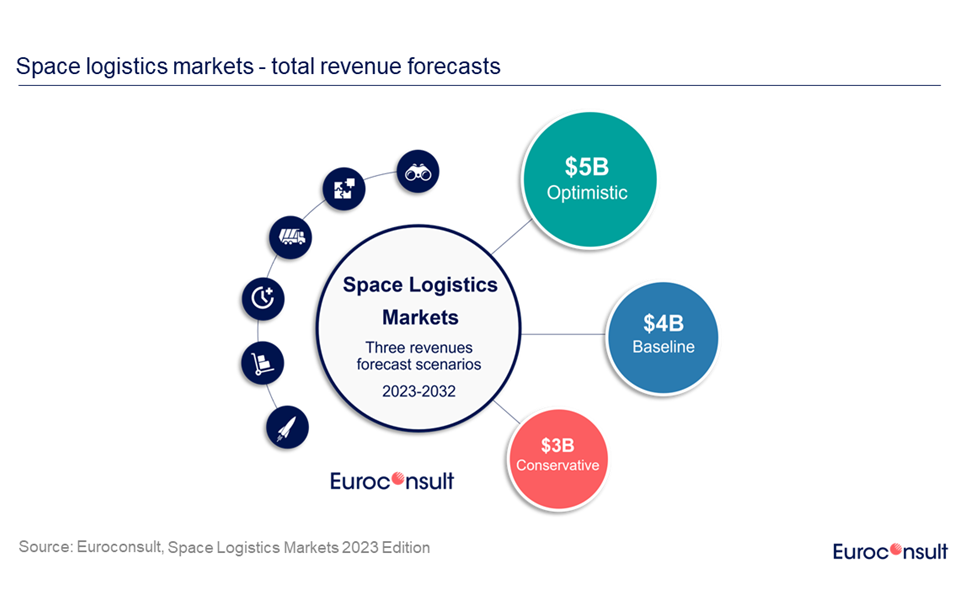

From the 38th Space Symposium in Colorado, Euroconsult releases its 2nd Space Logistics Markets report addressing growing flexibility needs in a complexifying orbital environment and anticipates three market trajectories for emerging in-orbit services leading to $4 billion a baseline scenario.

Paris, Washington D.C., Montreal, Yokohama, Sydney, April 17, 2023. An emerging set of in-orbit services aimed at increasing flexibility, sustainability, and safety for satellite operators from launch to end of life, could materialize into a space logistics ecosystem featuring frequent service interactions between spacecraft in orbit, according to leading space consultancy and market analysis firm Euroconsult in its recently published ‘Space Logistics Market’ report (2nd edition).

The report builds upon the popular first edition while introducing key innovations, including three market scenarios by vertical, taking place in different contextual settings, adding flexibility and precision to the analysis for the reader. The scenarios are determined by diverging different hypothesis through the decade, such as the availability or not of in-orbit refueling services, of reusable super heavy launchers, the decrease of launch price, the severity of the debris context and sustainability regulations, and competition from alternative, often more mature solutions.

Gabriel Deville, Consultant at Euroconsult and the report’s editor stated, “Despite ongoing demonstrations and early adopters, there here is still a long way to go before space logistics become a buyer’s market. However, growing flexibility and sustainable requirements in space are paving the way for more ambitious demonstrations and service concepts such as refueling-ready satellites, reusable orbital transfer vehicles, large scale on-orbit 3D printing and integrated catalogues of space objects with potential to redefine the economics of space in the long-term”.

Euroconsult highlights the growing importance of space sustainability, as global government agencies increasingly recognize the need to promote responsible behaviours in space and mitigate the multiplication of debris. The SSA market is the first beneficiary of this driver and is estimated to reach $1.8B in revenue over 2023 to 2032 in a baseline scenario, driven by growing orbital congestion. At the opposite end, the Last Mile Delivery market is estimated to be over ten times smaller and the satellite Life-Extension market, two times smaller.

Due to low service maturity overall, government agencies are expected to play a key role in market building by seeding technology development financially to increase TRL, providing anchor demand to enable demonstrations and service maturing, as well as defining regulatory frameworks to encourage service adoption and promoting standardization.

Space logistics will likely leverage the rapid structural changes occurring in the access to space industry, marked by the transition to a new generation of GTO-capable launchers, growing competition in all segments of the market, and the introduction of super heavy, fully reusable launchers. The report forecasts launch rates for each launcher category, confronting demand to supplier capabilities (including upcoming super heavy launchers) and anticipates up to 220 launches per year in the most optimistic scenario while expecting a threefold launch price decrease over the decade, owing to new design-to-cost value propositions and to the progress of reusability.

The six markets covered in the report are Access to Space, Last Mile Delivery, Satellite Life Extension, Active Debris Removal, On-Orbit manufacturing and Assembly and Space Situational Awareness

Euroconsult’s ‘Space Logistics Market report’ 2nd edition is out now and a free extract is available to download, featuring global trends and forecasts across six identified market verticals.

About the Report

A comprehensive analysis of the emerging space logistics markets, including last-mile delivery, in-orbit servicing, active debris removal, in-orbit manufacturing, and space situational awareness. The report maps out present solutions and those coming to the market, delves into the trends shaping these ecosystems and forecasts demand for the next decade.